فروشگاه قطعات آسانسور اُفق

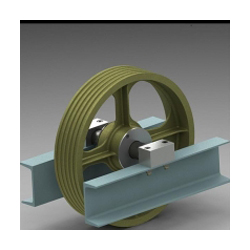

تولید فلکه هرزگرد گیرلس و گیربکس ضد سایش و انواع فلکه موتور ایرانی و خارجی

فروش 0 تا 100 قطعات آسانسور ایرانی و خارجی

ریل- موتور- درب لولایی و اتوماتیک- انواع کابین- مکانیک و راه اندازی آسانسور

اینجا همه چیز بهترین است.خوش آمدید

خدمات ما

در این بخش میتوانید با خدمات مجموعه ما آشنا شوید

مشاوره 66803238-021

فروش قطعات آسانسور ایرانی و خارجی

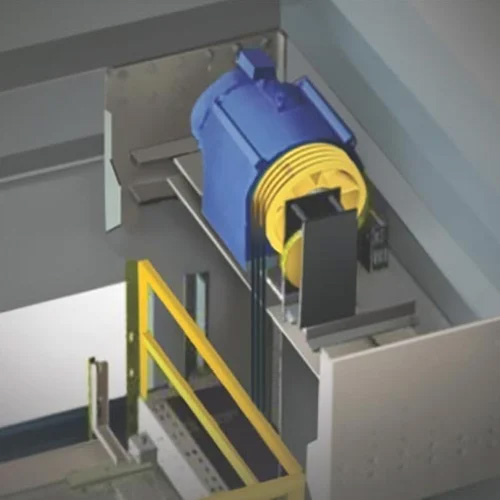

تعمیر موتور آسانسور گیربکس و گیرلس

تولید انواع فلکه هرزگرد و فلکه موتور ضد سایش

محصولات ما

در این بخش می تونید با محصولات ما آشنا شوید

مطالب مفید

بروز ترین مقالات در زمینه آسانسور را در این قسمت بخوانید

تعریف آسانسور و انواع آن

از بررسی معماری ساختمان ها در گذشته میتوان فهمید که در گذشته توان ساخت ساختمانهای بلند وجود داشته است، ولی شاید دلیل اینکه چرا این کار چندان رواج…

آسانسور هیدرولیکی چیست و جایگاه آن کجاست؟

آسانسور هیدرولیک آسانسور هیدرولیک حدود 60 سال پیش در صنعت آسانسورسازی به محبوبیت دست یافت. پیش از شروع قرن 21، با ورود آسانسورهای بدون موتورخانه…

درهنگام سقوط آسانسور چه کنیم؟

پدیده آسانسور مثل سایر پدیده های وارداتی، اول خودش آمد و بعد برای وارد کردن فرهنگ استفاده از آن تلاش شد. فرهنگستان زبان هم سال ها بعد از ورود این…

آسانسور گیرلس و روملس (بدون موتور خانه)

آسانسور روملس بیش از 15 سال از عرضه آسانسورهای جدید توسط یکی از بزرگترین کمپانی های آسانسور در دنیا میگذرد، این مدل از آسانسورها جایگزین مناسبی برای…